Bank Islami Car Loan Policy

With bank islami you can get a brand new vehicle with the tenure of auto financing from 1 to 7 years and customer equity of 15 to 90.

Bank islami car loan policy. Over the years hbl has grown its branch network and is currently the largest private sector bank with over 1 500 branches across the country. Under this joint partnership agreement bipl s share in vehicle is represented by musharakah units. Now you can receive your money from your loved ones abroad at any bankislami branch nationwide.

Quotation of purchasing car issued by car vendor showroom business card copy of office id of applicant and guarantor s copy of latest tax clearance certificate e tin latest 12 months bank statement for businessmen 06 months for others additional documents required for salaried person self employed. Hbl was the first commercial bank established in pakistan. The bank will rent out its share in vehicle to you in exchange for periodical rents claimed.

Hbl is the best bank for car loan offering lowest mark up of 10 09 and insurance rate of 2. Drive your dream car today with a little help from al islami auto finance. The application or processing fee for each case is rs 1 200.

Which means now drive the car of your dreams the. Hbl car loan makes it easy to. Features and benefits of bank islami car loan.

This plans covers all your needs whether the vehicle you wish to purchase is used or new for commercial or personal use. 250 000 and maximum rs. Earning of profit is not the only motive and objective of the bank s investment policy rather emphasis is given in attaining social goal and objective in creating employment opportunities.

Get your bank loan for car today and buy your dream car. While for financing amount you have a window of minimum rs. The special feature of the investment policy of the bank is to invest on the basis of profit loss sharing system in accordance with the tenets and principles of islamic shari ah.

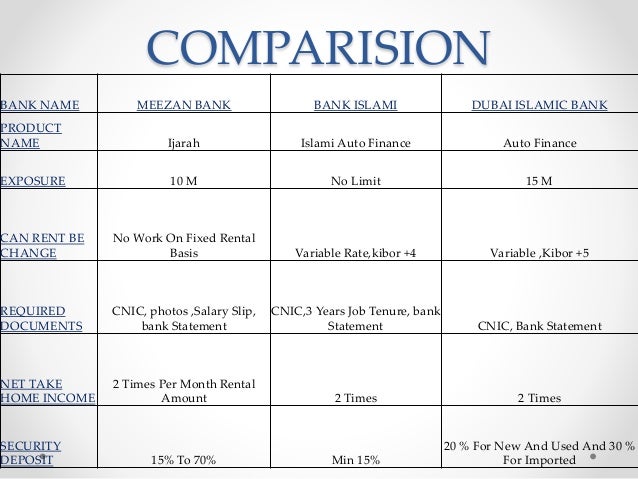

Bank islam can finance up to 90 of the car s price and is willing to give you a maximum period of nine years to pay off the loan amount. Islami auto finance facility is based on diminishing musharakah under shirkat ul milk arrangement. Bank islami is a growing islamic bank in pakistan and offers great convenience to have the car you want to purchase through shariah compliant way if you were ever held back from getting a car loan due to shariah non compliance all that can change in a few clicks thanks to the bank islami car finance scheme currently offered in pakistan.